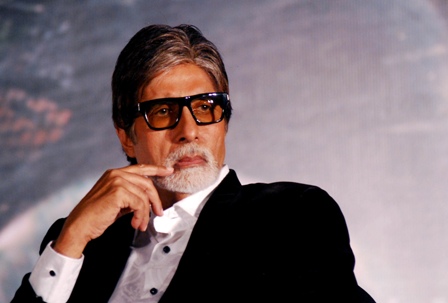

Amitabh Bachchan (Bollywood megastar ) has been appointed to promote Goods and Services Tax (GST) by the government, ahead of the sweeping tax reform’s implementation scheduled from July 1. The Central Board of Excise and Customs will be making the 74-year-old Bachchan brand ambassador for GST. A 40-second video featuring him has already been shot and is being circulated.

Amitabh Bachchan (Bollywood megastar ) has been appointed to promote Goods and Services Tax (GST) by the government, ahead of the sweeping tax reform’s implementation scheduled from July 1. The Central Board of Excise and Customs will be making the 74-year-old Bachchan brand ambassador for GST. A 40-second video featuring him has already been shot and is being circulated.

“GST – An initiative to create a unified national market,” the finance ministry said in a tweet, attaching the video.

In the video, Bachchan explains GST as an unifying force just like the three colours in the national flag. GST is an initiative to create ‘one nation, one tax, one market’, he says.

The Goods and Services Tax (GST) which has scheduled to be implemented from 1 July, the government finalised tax slabs for various goods and services.

According to the experts below is a listing of the goods and services will become cheaper or costlier after the GST comes in to force:-

Goods that will be cheaper

Corn flakes, Biscuits, Medicine, Ice cream, Packaged tea and coffee, Watches, Sweets, Cheese, Masala, Soaps, Hair oils, Two-wheelers, Toothpaste etc.

Services that will be cheaper

Restaurants, Dhabas, AC train travel, Air travel, Radio taxi, Movies and Entertainment services including others

Goods that will be costlier

Cigarettes, Mobile phones, Butter, Packaged chicken, Bhujia, Edible oil, Air- coolers and conditioners, Refrigerators, Washing machines, Coal, Steel, Computers – Laptops, Desktops, Monitors and printers,

Electronic Goods, Paint

Services that will be costlier

Online shopping, Mobile phone bills, Insurance premiums and other fees, Banking charges, Internet wifi

DTH services, School fees, Courier services includign others.

The taxes are set on a four slab rate – 5%, 12%, 18% and 28%.